A common question we’re often asked is whether a PPI refund needs to be declared on your Self-Assessment Tax Return.

Do I need to include PPI on my tax return?

The short answer is YES, but not all of it. Read on to find out what you need to declare on your tax return, where to get the figures from and which boxes to fill in.

It is extremely important that you enter the correct figures in the right boxes to ensure you successfully recover any overpaid tax on your PPI payout. A mistake here could be costly and actually lead to you paying MORE tax on your refund.

What you need to declare on your Tax Return

PPI payouts usually consist of 3 elements

- A refund of the actual PPI premiums paid

- Interest (if the PPI was added to your loan)

- Statutory Interest (also referred to as compensatory interest)

You can find a breakdown of these figures on your final settlement letter that your bank / lender sent you when you made your PPI claim.

This letter will also show the amount of tax that was deducted from your refund (it is usually 20% of the Statutory Interest).

You only need to declare the Statutory Interest part of your PPI payout on your Tax Return. The figure you should use is the amount after tax.

The other elements (PPI premiums and associated interest charges) are not classed as “earned income” and are therefore not subject to tax and do not need to be declared on your tax return.

Where to enter the figures

If you file your tax return online:

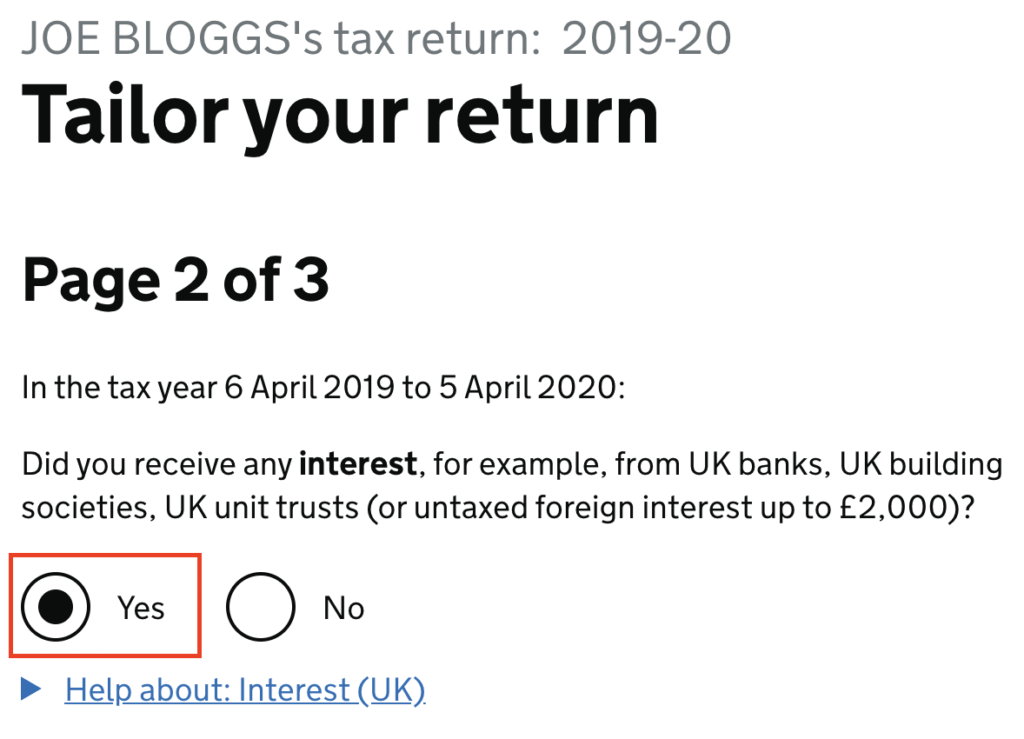

Step 1: On the ‘Tailor your return’ page, select YES to the question “Did you receive any interest, for example, from UK banks, UK building societies, UK unit trusts (or untaxed foreign interest up to £2,000)?”

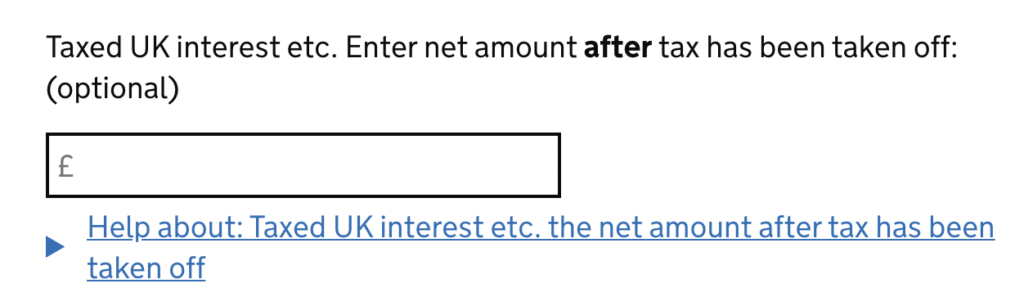

Step 2: In the ‘UK Interest’ section, enter your total Statutory Interest after tax in the ‘Taxed UK Interest etc‘ box. Take care to put the figure in the correct box to ensure the tax (or tax refund) is correctly calculated.

If you file your tax return on paper:

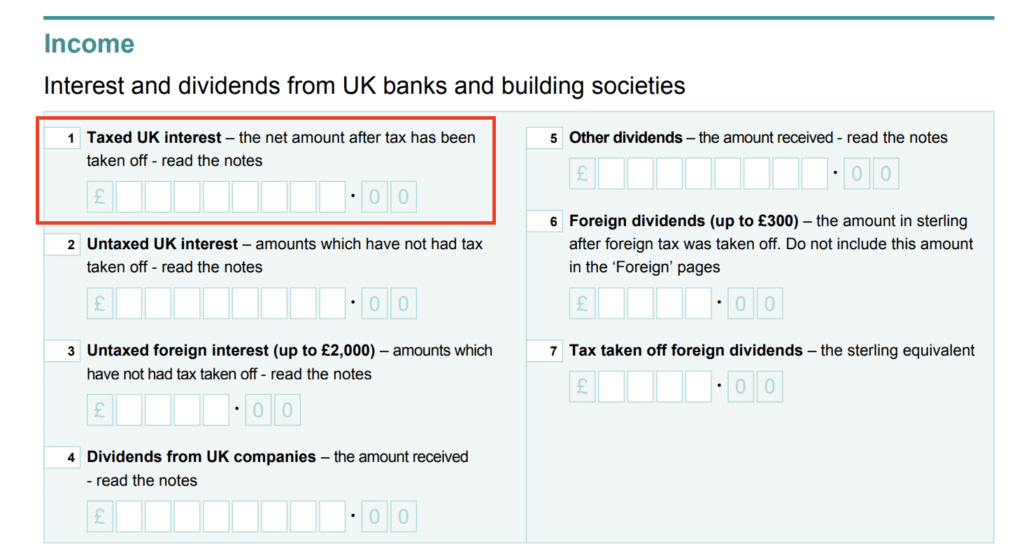

The correct box to enter your PPI interest is Box 1 of the Income (Interest and Dividends from UK Banks and Building Societies) page. You should enter Statutory Interest after tax has been deducted (If you received multiple refunds, enter the total figure from all payments)

If you don’t have the settlement letter

You should be able to contact your lender and obtain a copy. If you are unable to obtain a copy, you should contact HMRC for further advice.

Settlement letter dated in 2022/23 tax year. Actual letter enclosing cheque is dated 6.4.23 as is cheque. Ie two different tax years

I am assuming the compensation interest is taxable in 2022/23

It should be the date you received the refund – so in this case go with the letter with the cheque. Although HMRC would probably accept either date.